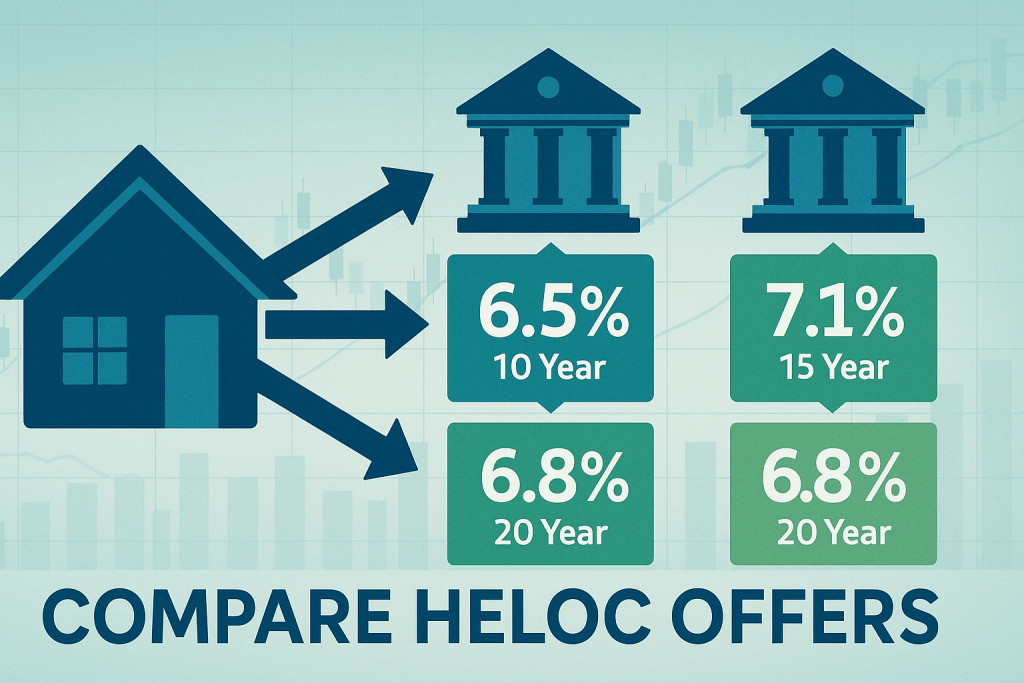

Are you thinking about accessing your home’s equity for a financial need? A home equity line of credit can provide flexible funding, but comparing offers is essential to securing the best terms. Lenders offer different rates, fees, and repayment structures, making it crucial to evaluate each option carefully.

When reviewing a HELOC, the focus should be on interest rates, repayment terms, and associated costs. Understanding these factors will help you choose a suitable option that aligns with your financial goals. Since lenders structure their offers differently, a side-by-side comparison ensures you make an informed decision.

Compare Interest Rate Types and Their Long-Term Impact

One key factor to compare is the type of interest rate offered. Some lenders provide fixed rates, while others offer variable rates based on market conditions. A fixed rate remains constant throughout the loan term, making budgeting easier.

In contrast, a variable rate may start lower but can fluctuate, affecting monthly payments. Check the rate index and margin used to calculate variable rates. If choosing a fixed rate, confirm whether it applies to the entire term or only a portion of the balance. Understanding how interest accrues can help you estimate the total cost over time.

Analyze Introductory Rates and Future Adjustments

Many lenders offer promotional rates for a limited period. These introductory rates can be appealing, but it’s important to understand what happens once they expire. Some lenders increase the rate significantly after the promotional period, while others apply a gradual adjustment.

Review the terms regarding rate changes. If an offer includes an introductory rate, check the standard rate that applies afterward. This ensures you won’t face unexpected increases in your monthly payments. Always calculate potential costs beyond the initial period to avoid surprises.

Evaluate Fees and Hidden Costs Across Lenders

Beyond interest rates, comparing fees is essential. Lenders may charge application fees, origination fees, and annual maintenance fees. Some also require closing costs, which can include appraisal and title search fees. Carefully scrutinizing these fees can significantly impact the overall cost of the loan.

Request a detailed fee breakdown from each lender. Some providers waive certain fees, reducing upfront expenses. Compare offers based on initial and long-term costs to determine which option provides the best overall value.

Compare Draw and Repayment Terms to Find the Best Fit

Each HELOC has a draw period and a repayment period. The draw period allows access to funds and typically lasts five to ten years. After this, repayment begins, often requiring principal and interest payments. The repayment structure varies by lender, with some offering flexible options while others requiring fixed monthly installments.

Check whether the lender allows interest-only payments during the draw period. This option provides lower payments initially, but the balance remains unchanged until the repayment phase begins. Understanding these terms helps in planning for future financial obligations.

Check for Prepayment Penalties and Extra Charges

Some lenders charge prepayment penalties if you repay the balance early. These fees can reduce potential savings if you plan to pay off the loan beforehand. Check whether an offer includes penalties and how they apply. Other costs may consist of inactivity fees or rate lock fees.

Reviewing the fine print ensures you’re aware of all potential expenses. Choosing a lender with fewer restrictions provides more flexibility in managing your loan. Amerisave offers competitive loan options that cater to various financial needs, making it a key lender to consider.

A detailed comparison of interest rates, fees, and repayment terms helps select the right HELOC. Evaluating offers side by side ensures you secure favorable terms that fit your financial situation. Take the time to review all aspects before committing to an offer, ensuring you maximize the benefits of your home’s equity.